In our last VTS Office Demand Index (VODI) report, we highlighted the nearly 20% YoY growth in new demand nationally, with certain marks such as New York City up even more (+40% YoY).

That trend has continued into 2024. Through February, national office demand is up 27% vs. the same period in 2023. While still 35% below pre-Covid levels, markets such as New York City and Los Angeles have started the year at or above pre-Covid levels of demand.

Institutional investors have recognized this as well, with sentiment from the likes of Boston Properties, Brookfield, Blackstone, and others implying a shift towards capital deployment this year.

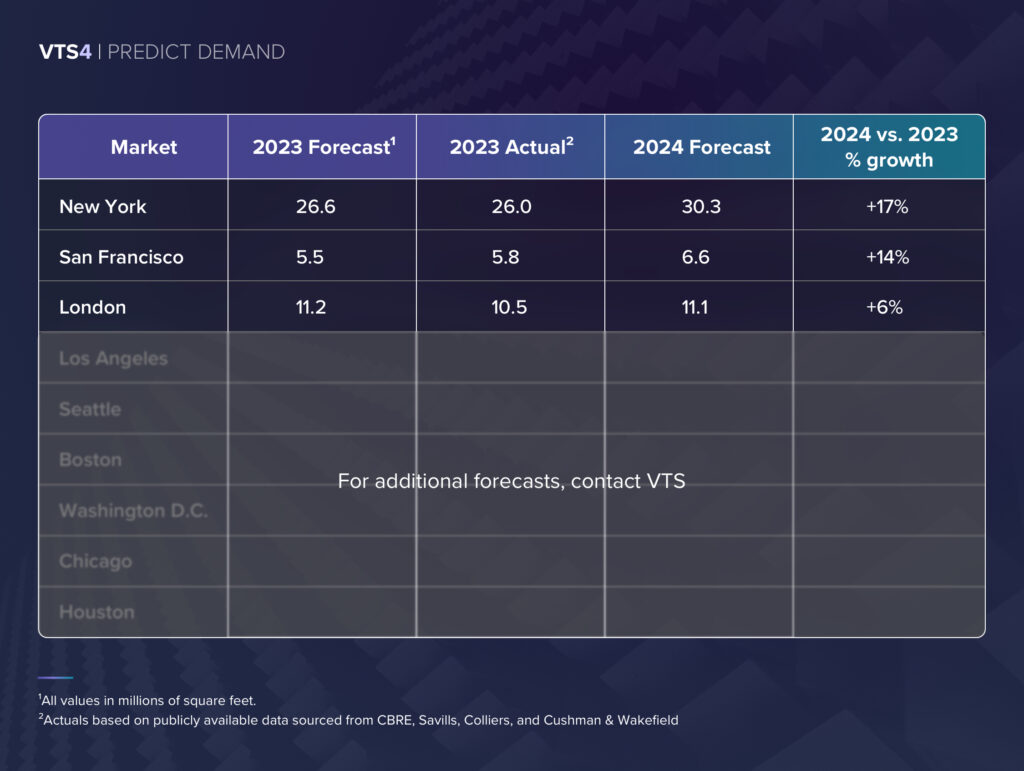

VTS has analyzed our office demand data, the industry’s earliest leading indicator of office leasing, to forecast leasing trends across three of the world’s most influential markets: New York City, San Francisco, and London. These three markets exude an outsized amount of global influence in CRE due to their level of capital and talent and have come up repeatedly in institutional circles as being ripe for investment over the next 18-24 months.

An internal analysis conducted by VTS Research found San Francisco to be the highest risk/reward opportunity, followed by New York City and then London, with New York City offering the best risk-adjusted return profile.

With the launch of VTS 4, powered by the VTS Demand Model, we are bringing all of our predictive market data in-app to our customers for the first time. This lets our customers understand leasing trends 6-12 months before being recorded. As a result, we can make credible forecasts around the trajectory of leasing and net absorption.

Below is the VTS Leasing Prediction Outlook for the three markets mentioned above. New York City and San Francisco are forecast to grow 17% and 14%, respectively. London, where new demand velocity returned to pre-Covid levels in April 2021 and has remained there for ~3 years, is forecast to grow 6% YoY.

Request a demo today for more information on VTS 4 or to unlock the forecast for the above markets.